…

What is the Cost of Medigap Plans in Georgia?

In Georgia, what is the cost of Medigap plans? What do Georgia Medigap plans cover? Which companies offer Medicare supplement insurance? Is Medicare plan F the best? Should I buy a plan from Blue …

Continue Reading about What is the Cost of Medigap Plans in Georgia? →

Who Has the Best Medicare Supplement Rates in 30252?

Seniors living in McDonough, GA want to know "Who has the best Medicare supplement rates in zip code 30252?". The best Medigap rates are for those in good health. Most of the time we save our …

Continue Reading about Who Has the Best Medicare Supplement Rates in 30252? →

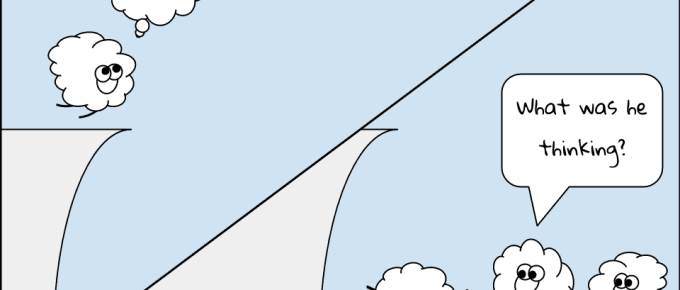

Thinking About Dropping My Medicare Advantage Plan

I got a call last week from a lady who asked "I am thinking about dropping my Medicare Advantage plan. How do I do it?". Ruth was in good health, but her husband was not. His Medicare Advantage plan …

Continue Reading about Thinking About Dropping My Medicare Advantage Plan →

How Do I Find the Best Medicare Supplement Plan in Georgia?

Looking for the best Medicare supplement plan in Georgia? Where to start? How much will it cost? How can I save money but still have the best Medigap plan? The best Medicare supplement plan …

Continue Reading about How Do I Find the Best Medicare Supplement Plan in Georgia? →

Georgia Farm Bureau Medicare Supplement Plans

Georgia Farm Bureau Medicare supplement plans are now available, but are they competitive? Which Medigap plans do they offer? Are GFB supplement insurance plans available in all counties? How do I …

Continue Reading about Georgia Farm Bureau Medicare Supplement Plans →