SNP Medicare plans are Special Needs Plans for a certain class of Medicare beneficiary. Many who qualify for SNP's are considered dual eligible (qualify for Medicare and Medicaid). Special Needs …

Piedmont Wellstar Medicare Advantage 2016

The popular Piedmont Wellstar Medicare Advantage HMO plan will not be available in 2016. Existing members have received their non-renewal notice and now begins the task of finding new …

Continue Reading about Piedmont Wellstar Medicare Advantage 2016 →

How to Find the Right Medicare Plan

Scroll down for UPDATE Do you want to know the secret of how to find the right Medicare plan when you turn 65? Medicare supplement plan F or a $0 premium Medicare Advantage plan? What's the big …

Continue Reading about How to Find the Right Medicare Plan →

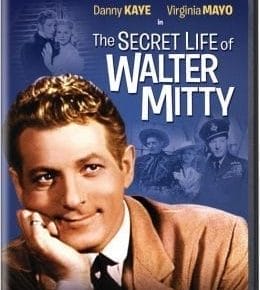

The Secret Life of Medicare Advantage Plans

Medicare Advantage plans have a secret life. The carrier won't tell you. Neither will the agent. If you knew these secrets you might change your mind about signing up for one. Consider this. Why does …

Continue Reading about The Secret Life of Medicare Advantage Plans →

How Obamacare Impacts Medicare Advantage Plans

Obamacare affected under age 65 health insurance but left Medicare alone. That popular belief is incorrect. Obamacare (ACA) reduces funding for Medicare plans and cut's reimbursement to carriers. …

Continue Reading about How Obamacare Impacts Medicare Advantage Plans →

Lagrange Medigap Rates

Lagrange Medigap rates vary considerably for the exact same plan. How do you find the plan that is right for you? Medicare supplement plan F is the most popular plan in Georgia and we have the …