Medicare supplement plan G delivers great value. Seniors in Georgia on a fixed income will save money when they choose Medigap plan G. Medigap plan G has all the benefits of Medicare supplement plan F …

Medicare Supplement Plan F 2020

What does Medicare supplement plan F cover? Does Medigap plan F cover catastrophic illness? How much does it cost? Is Medicare supplement plan F the best? Signing up for Medicare …

Hospital Admission – In or Out?

Original Medicare offers excellent hospital admission coverage under Medicare Part A. But how is your hospital bill treated under Part B? Are you in or out? Full Part A coverage for up to 60 …

Medicare Open Enrollment 2015

The Medicare open enrollment 2015 edition opens October 15 and closes December 7. If you are turning 65 you will be making decisions along with 48 million retirees looking to change their plans. …

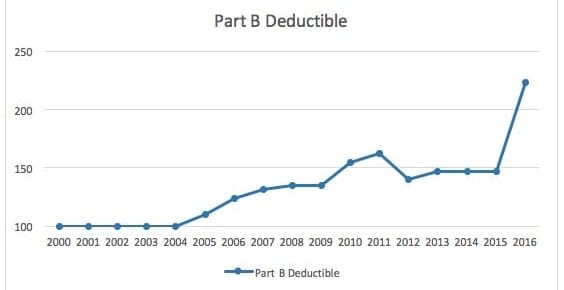

Medicare Part B Premiums Rise In 2022

Your 2022 Medicare Part B premiums are going up. A lot. So are deductibles. Oh, and Medigap plan F was retired in 2020. The same year the Part D donut hole closes and you pay more in premiums, copay's …

Continue Reading about Medicare Part B Premiums Rise In 2022 →

83-year-old LA man on Social Security is charged $24,000 by AT&T for using dial-up internet with faulty modem

Ron Dorff, of Woodland Hills, Los Angeles, first contacted the telecommunications giant after seeing his monthly phone bill rocket from $51 to $8,596.57. Source: 83-year-old LA man on Social …