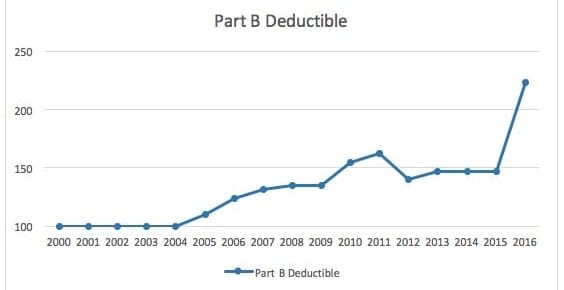

Medicare cost is the sum of premiums paid plus your OOP (out of pocket) costs for health care. When you are admitted to the hospital you encounter a Medicare Part A deductible of $1556 PER ADMISSION. …

Continue Reading about How Much Does Medicare Cost in 2022 →