Medicare supplement plan G delivers great value. Seniors in Georgia on a fixed income will save money when they choose Medigap plan G. Medigap plan G has all the benefits of Medicare supplement plan F …

Do I Need an Insurance Agent?

Do I need an insurance agent to buy a Medicare supplement plan? How much extra will I pay to buy through a broker? Do insurance agents offer the same plans that I can get direct from a carrier? Don't …

Blue Cross Medicare Supplement Plans 2017

Georgia Blue Cross Medicare supplement plans from Anthem. What's new for 2018? SILVER SNEAKERS. How do their Medigap rates look? If you are turning 65 is a Medicare supplement plan right for …

Continue Reading about Blue Cross Medicare Supplement Plans 2017 →

Why Are Georgia Medigap Rates So High?

Why are Georgia Medigap rates so high? Which Medicare supplement carrier raises rates the most? Why are (this carriers) Medigap rates going up so much? Which carrier raises rates more? UPDATE 2017 - …

Continue Reading about Why Are Georgia Medigap Rates So High? →

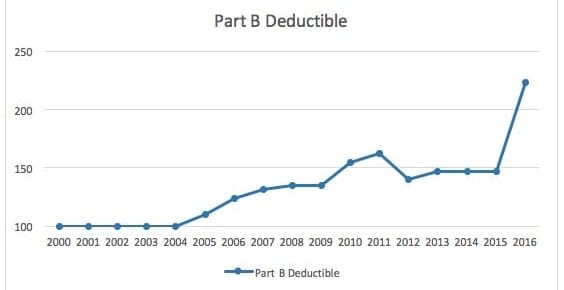

Medicare Part B Premiums Rise In 2022

Your 2022 Medicare Part B premiums are going up. A lot. So are deductibles. Oh, and Medigap plan F was retired in 2020. The same year the Part D donut hole closes and you pay more in premiums, copay's …

Continue Reading about Medicare Part B Premiums Rise In 2022 →

Medicare Changes Cost Retirees

Proposed Medicare changes in the way doctors are paid could mean YOU pay more for your health care. While Congress tries to contain the cost of Medicare it is obvious they are not thinking of you. …