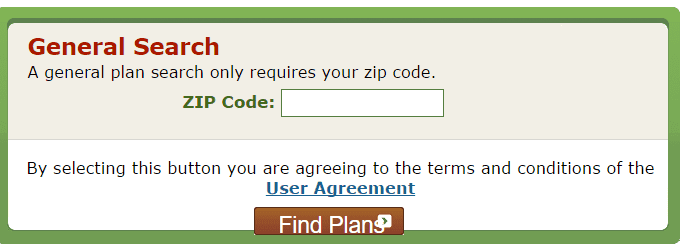

Medicare resource for free and low cost prescription drugs. Are you 65 or older and can't afford your medications? Paying too much for generics? Medicare's annual election period, commonly referred to …

Continue Reading about Free and Low Cost Prescription Drugs →