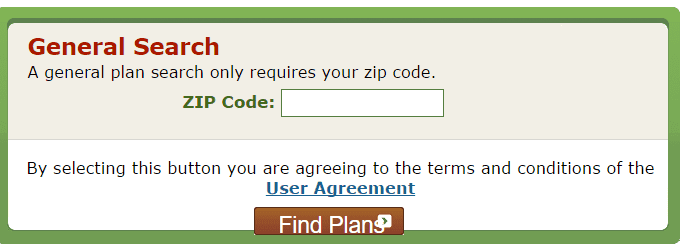

Using the Medicare Drug Plan Finder can be challenging. You can do it yourself, ask an agent, ask the Medicare drug plan carrier or call 1-800-MEDICARE (1-800-633-4227). We will show you step by …

Medicare Drug Plan – Save Money

Save money on your Medicare drug plan with simple changes. Avoid the donut hole. Turning 65? The drug plan with the lowest premium may cost you the most. Medicare Advantage may be your …