Do all doctors take Medicare? The answer may surprise you. Which Medicare plans are widely accepted by Georgia doctors? Can my doctor refuse to take my Medicare plan? What happens then? How do I find …

Health Care At Your Fingertips

Health care. Now there's an app for that. At Georgia Medicare Plans we believe in open access to health care information. When patients, consumers and their medical providers have access to …

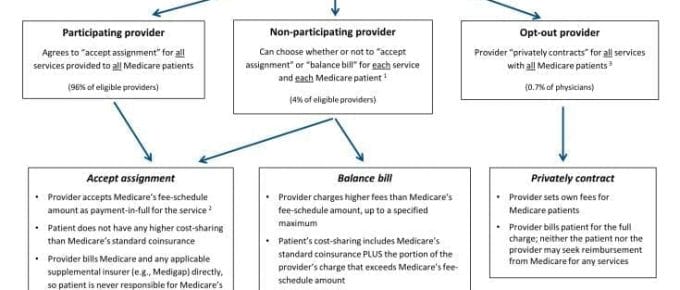

When Your Medicare Plan Doesn’t Pay

What happens when your Medicare plan doesn't pay a claim? Do you still owe the bill? Can your doctor or other medical provider make you pay a claim denied by Medicare? Can your doctor balance bill you …

Continue Reading about When Your Medicare Plan Doesn’t Pay →

What Causes Heart Disease – Science or Sham?

What really causes heart disease? Diet? Lifestyle? Does Dr. Dwight Lundell have the answer? Or is it all a sham? Can damage to the heart be reversed? Causes of Heart Disease Can we prevent heart …

Continue Reading about What Causes Heart Disease – Science or Sham? →

The Medicare Advantage Convenience Factor

Why choose a Medicare Advantage plan over original Medicare? Is it the Medicare Advantage convenience factor as proposed by Dr. David Mokotoff at KevinMD? Is one-stop-shopping the driving force or is …

Continue Reading about The Medicare Advantage Convenience Factor →

My Doctor Was Fired – What Now?

What happens if your doctor was fired by your Medicare Advantage plan? It happens. With reduced Medicare funding under Obamacare it will be more difficult to keep your doctor no matter how much …