Medicare Help Center. Medicare insurance complaints. Should I be concerned? Complaints can fall into many areas, including: Why is my renewal premium so high?Will my doctor accept this …

AARP – Is It Worth It?

AARP membership is only $16, but is it worth it? What do you really get for your membership fee? How does AARP provider all these benefits for only $16? How is AARP funded? Are their discounts on …

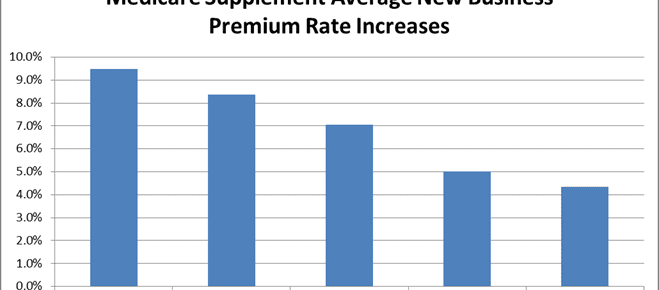

Medicare Supplement Rates Trend Lower

Medicare supplement rates still increase every year but the increases are trending lower. Double digit renewals have declined since 2010. Rate changes on new business have also declined to the 5% …

Continue Reading about Medicare Supplement Rates Trend Lower →

Mining for Gold in the Silver Market

Data miners are mining for gold among silver (and blue) haired retirees. Is your private information really private? How do you protect your personal information from being mined for gold and …

Continue Reading about Mining for Gold in the Silver Market →

Who Has the Best Medigap Plans in Georgia?

Which Georgia carrier has the best Medigap plans? Who has the lowest rates for GA Medicare supplement insurance? Will all doctors take my Medigap plan? Am I better off to buy direct from a well known …

Continue Reading about Who Has the Best Medigap Plans in Georgia? →

My Doctor Was Fired – What Now?

What happens if your doctor was fired by your Medicare Advantage plan? It happens. With reduced Medicare funding under Obamacare it will be more difficult to keep your doctor no matter how much …