Medicare Help Center. Medicare insurance complaints. Should I be concerned? Complaints can fall into many areas, including: Why is my renewal premium so high?Will my doctor accept this …

Mutual of Omaha Medicare Supplement Plans

Mutual of Omaha offers Medicare supplement plans A, F, G and M. Moderately competitive rates, they trade on their name recognition. Renewal rates tend to be on the high side. Shop and compare Mutual …

Continue Reading about Mutual of Omaha Medicare Supplement Plans →

Mutual of Omaha Medicare Supplement Rate Increases

Mutual of Omaha Medicare supplement rates increase annually. Most Georgia Medigap rates increase only once a year while others may increase twice in the same year. Mutual Medicare supplement rates …

Continue Reading about Mutual of Omaha Medicare Supplement Rate Increases →

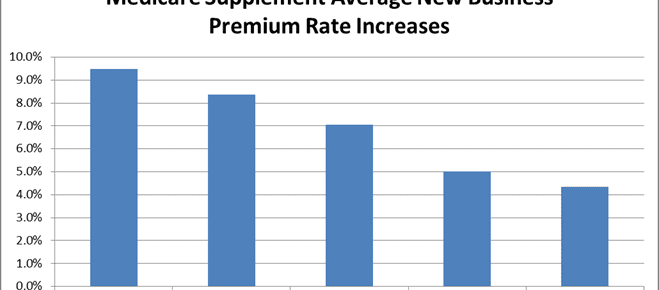

Medicare Supplement Rates Trend Lower

Medicare supplement rates still increase every year but the increases are trending lower. Double digit renewals have declined since 2010. Rate changes on new business have also declined to the 5% …

Continue Reading about Medicare Supplement Rates Trend Lower →

Mutual of Omaha Plan N Rate Increase

Mutual of Omaha will be raising rates on Medigap plan N. The plan was introduced by United of Omaha (a Mutual of Omaha subsidiary) in 2010 and pulled from the market less than a year later. …

Continue Reading about Mutual of Omaha Plan N Rate Increase →

Mutual of Omaha Medicare Supplement Rate Increases

Mutual of Omaha Medicare supplement rate increases seem to be a popular topic on the web. Hardly a day goes by that Georgia Medicare Plans does not have visitors looking for answers to why their …

Continue Reading about Mutual of Omaha Medicare Supplement Rate Increases →