You are turning 65. What are the Medicare traps and mistakes most retirees make in navigating the Medicare maze? One wrong decision can cost you thousands of dollars. Your choice is much more …

Anthem Blue Cross Hacked

Anthem Blue Cross recently made headlines but for all the wrong reasons. A "sophisticated" attack on their computer systems exposed millions of customer personal data to hackers. Current and former …

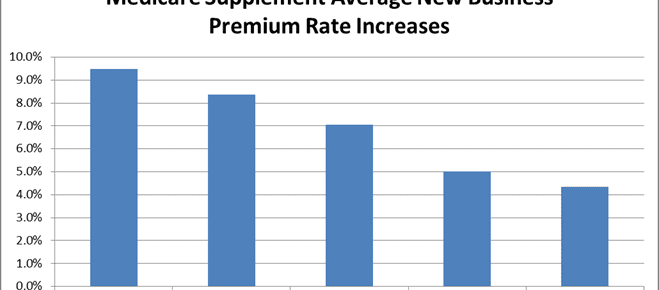

Medicare Supplement Rates Trend Lower

Medicare supplement rates still increase every year but the increases are trending lower. Double digit renewals have declined since 2010. Rate changes on new business have also declined to the 5% …

Continue Reading about Medicare Supplement Rates Trend Lower →

Super Low Medigap Rates – Trusted Carrier Takes Georgia By Storm

Are you looking for super low Medigap rates, but you don't trust new carriers with names that are unfamiliar? Medicare supplement carriers come to Georgia all the time to test the market. Sometimes …

Continue Reading about Super Low Medigap Rates – Trusted Carrier Takes Georgia By Storm →

How Much Does a Good Medigap Plan Cost in Georgia?

Have ever wondered "How much does a good Medigap plan cost in Georgia"? The short answer is, a lot less than a bad plan. Where can I find an affordable Medicare supplement plan? How can I tell a good …

Continue Reading about How Much Does a Good Medigap Plan Cost in Georgia? →

Blue Cross Medicare Plans – Your Questions Answered

We get mail. You have asked about Blue Cross Medicare supplement rates and renewal increases, and how high deductible plan F works. Is the BCBSGA Medigap plan F a good deal or a ripoff and can you …

Continue Reading about Blue Cross Medicare Plans – Your Questions Answered →