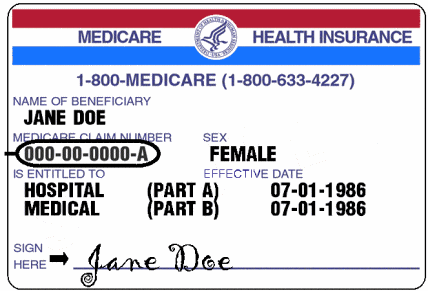

The Identity Theft and Tax Fraud Prevention Act of 2015 is proposed legislation whose time has come. Retirees are easy targets and carrying a Medicare card with your Social Security number on it is an …

Health Care Fraud – Medical Identity Theft

Health care fraud and medical identity theft is a growing concern for Georgia retirees on Medicare. Stone Mountain nurse convicted of health care fraud. New study finds medical identity theft grew by …

Continue Reading about Health Care Fraud – Medical Identity Theft →

Anthem Blue Cross Hacked

Anthem Blue Cross recently made headlines but for all the wrong reasons. A "sophisticated" attack on their computer systems exposed millions of customer personal data to hackers. Current and former …

Is Your Medical History a Target for Thieves?

Is your medical history safe from prying eyes? Do you trust your doctor? Where is your data most vulnerable? Why would thieves want your health history? How can you protect …

Continue Reading about Is Your Medical History a Target for Thieves? →