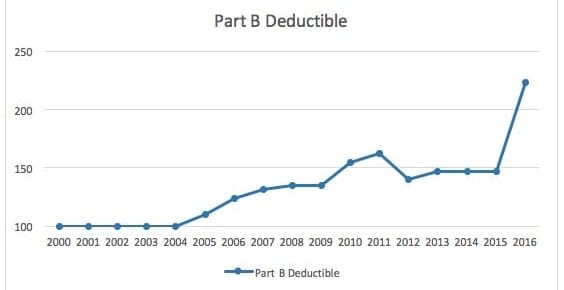

Your 2022 Medicare Part B premiums are going up. A lot. So are deductibles. Oh, and Medigap plan F was retired in 2020. The same year the Part D donut hole closes and you pay more in premiums, copay's …

Continue Reading about Medicare Part B Premiums Rise In 2022 →