Gainesville Medigap rates vary considerably for the exact same plan. How do you find the plan that is right for you? Medicare supplement plan F is the most popular plan in Georgia and we have the best …

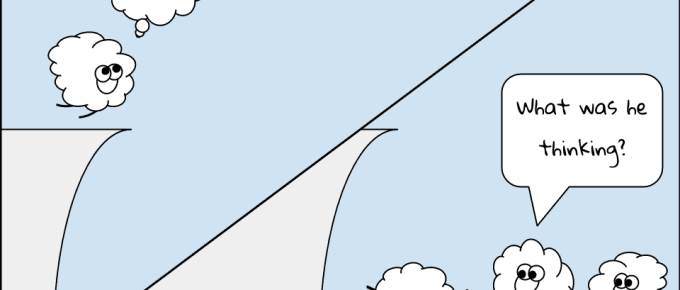

How Not to Shop for Medicare Insurance

Do you know how NOT to shop for Medicare insurance? Where is the last place to look for information? What is your most useful guide to Medicare insurance options? How do you find reliable information …

Continue Reading about How Not to Shop for Medicare Insurance →

What is the Cost of Medigap Plans in Georgia?

In Georgia, what is the cost of Medigap plans? What do Georgia Medigap plans cover? Which companies offer Medicare supplement insurance? Is Medicare plan F the best? Should I buy a plan from Blue …

Continue Reading about What is the Cost of Medigap Plans in Georgia? →

How Do I Find the Best Medicare Supplement Plan in Georgia?

Looking for the best Medicare supplement plan in Georgia? Where to start? How much will it cost? How can I save money but still have the best Medigap plan? The best Medicare supplement plan …

Continue Reading about How Do I Find the Best Medicare Supplement Plan in Georgia? →

Proposed Medicare Changes Will Hurt Georgia Seniors

The DC spending monster is hungry and proposed Medicare changes means they expect Georgia seniors to feed them. Their solution calls for shared funding and shared responsibility. That translates into …

Continue Reading about Proposed Medicare Changes Will Hurt Georgia Seniors →

First Timer’s Guide to Medicare 2018

Do you need a first timer's guide to Medicare? It doesn't matter if you are turning 65 and this is your first time in Medicare or you are an "old hand" looking at the 2018 Medicare open enrollment …

Continue Reading about First Timer’s Guide to Medicare 2018 →